Governor of the Bank of Ghana, Dr Johnson Asiama, has said that the measures introduced by the central bank aimed at restoring remittance inflows are beginning to yield positive results.

He said some Money Transfer Operators (MTOs) have started rerouting flows back into the country, which is encouraging.

The objective, he said, remains to strengthen interbank market activity and enhance liquidity.

Recently, the BoG issued a notice– Notice No. BG/GOV/SEC/2025/20 – citing continued violations of remittance rules by financial institutions. The breaches include terminating remittances via unapproved channels, applying unauthorised forex rates and failing to disclose full transaction logs.

According to the central bank, these practices were undermining transparency and weakening the country’s foreign exchange position. In response, BoG mandated weekly reporting of remittance inflows per MTO, including daily disbursement records and foreign exchange credits into Nostro accounts. Failure to comply, the Bank warned, would attract sanctions.

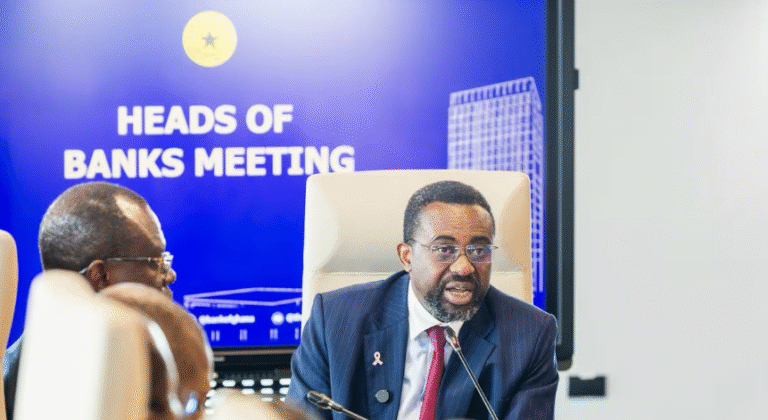

Answering a question about whether there were any unusual developments or deviations from expected trends relative to remittances during the 126th Monetary Policy Committee (MPC) press conference in Accra.

In answer, he said, “Yes, the banks have confirmed a noticeable decline in remittance inflows. Previously, these inflows played a significant role in supporting import financing, which in turn facilitated active interbank trading. During that period, the central bank’s intervention in the market was minimal. However, with the recent reduction in inflows, the dynamics have shifted.

“We are actively addressing this issue. About a month ago, we introduced a series of measures aimed at restoring remittance inflows, and we are beginning to see positive results. Some Money Transfer Operators (MTOs) have started rerouting flows back into the country, which is encouraging. Our objective remains to strengthen interbank market activity and enhance liquidity.”

Looking ahead, he added “we remain optimistic that our annual remittance targets will be met. While the earlier appreciation of the cedi may have influenced inflows to some extent, the key point is that we have taken proactive steps to reverse the trend and ensure that remittances continue to support the broader economy.”

Source:Lovinghananews.com