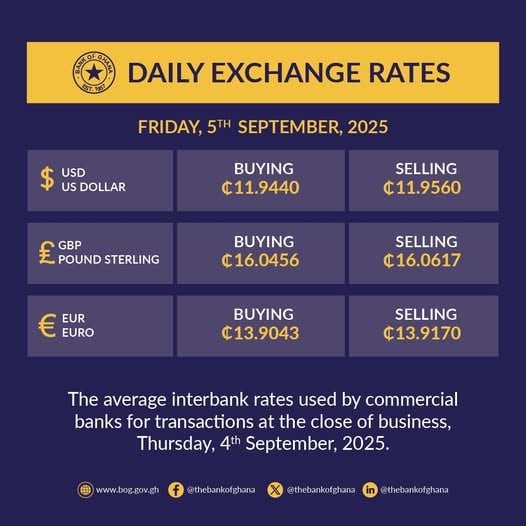

The Cedi has depreciated again per the rate from the Bank of Ghana (BoG) on Friday, September 5.

On Friday, it was selling at 11.9560 and buying at 11.9440 to the dollar. With the Pound, it was selling at 16.0617 and buying at 16.0456.

The Euro was selling at 13.9170 and buying at 13.9043.

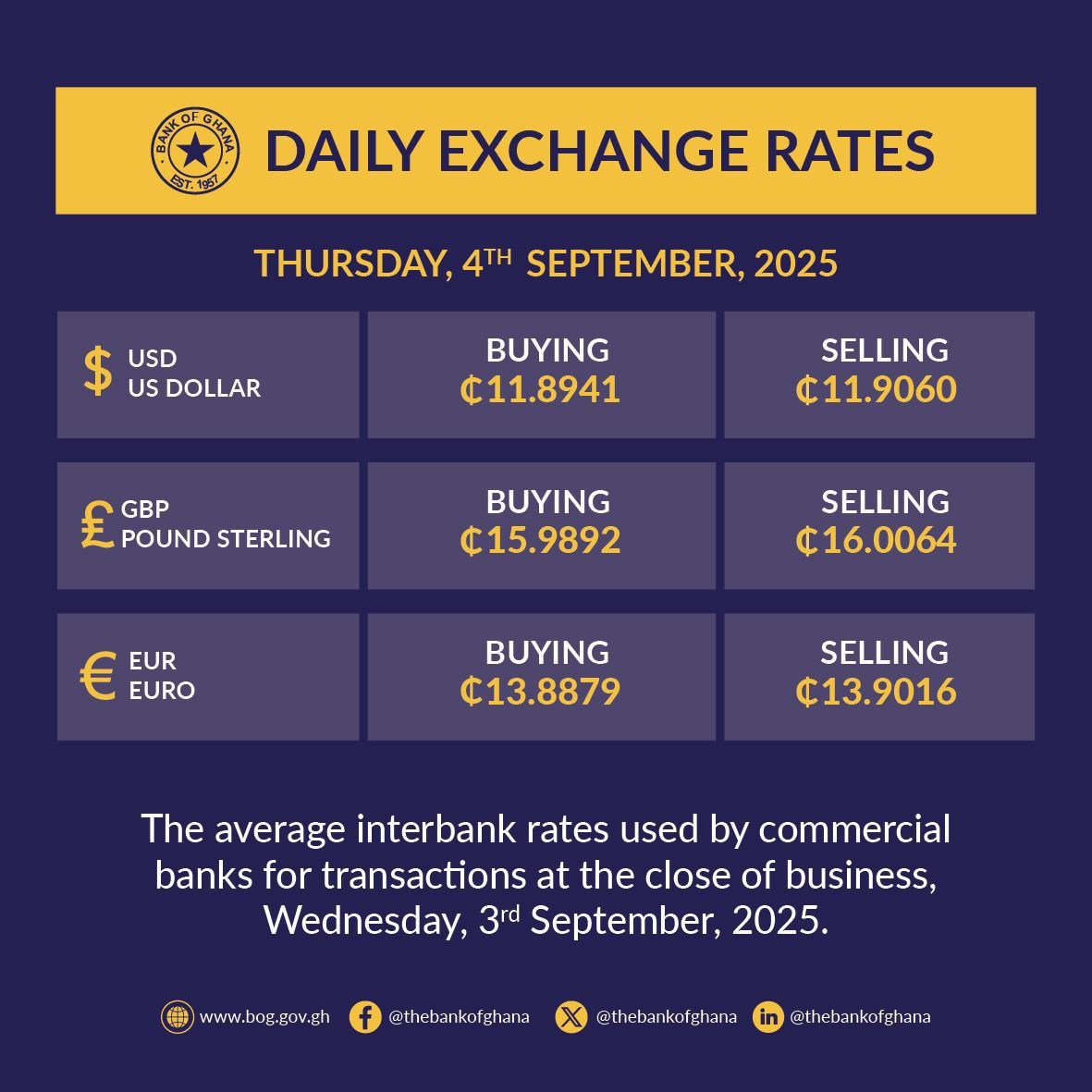

On Thursday, September 4, the Cedi was selling at 11.9060 and buying at 11.8941 to a dollar.

The recent marginal depreciation of the Cedi has raised concerns among the trading public.

The central bank has, however, taken steps to strengthen the Cedi. The Bank of Ghana reiterated the caution to institutions and individuals against charging or accepting payments in foreign currencies for goods and services in Ghana, stressing that the Ghana cedi remains the only legal tender.

In a notice issued on Wednesday, August 27, 2025, the central bank reminded the public that under the Foreign Exchange Act, 2006 (Act 723), it is illegal for any person or institution without authorisation to engage in foreign exchange transactions.

These include black market dealings, pricing, invoicing or advertising in foreign currencies, particularly the United States dollar.

“The Ghana cedi remains the only legal tender in Ghana,” the notice signed by Mrs Aimee V. Quashie, Secretary to the Bank, said.

It added that no resident of Ghana, unless duly licensed or authorised by the Bank of Ghana, should price, advertise, invoice, or receive payment in any foreign currency.

The directive covered transactions such as the payment of school fees, the sale and rental of vehicles, the sale and rental of real estate, airline tickets, domestic contracts, retail shopping, online sales and hotel accommodation.

According to the BoG, foreign currency invoices may be issued only to expatriates or non-residents, with proceeds required to be paid into a Foreign Exchange Account (FEA) with licensed banks.

The Bank further stated that exchange rates on such invoices must reflect prevailing market rates of commercial banks and be benchmarked against its published reference rate.

The Bank of Ghana said foreign exchange transfers for legitimate external payments remain permitted through the banking system, subject to regulatory limits and procedures.

It cautioned that enforcement would continue and warned that persons or institutions found to be in breach would face sanctions and prosecution in line with Act 723.

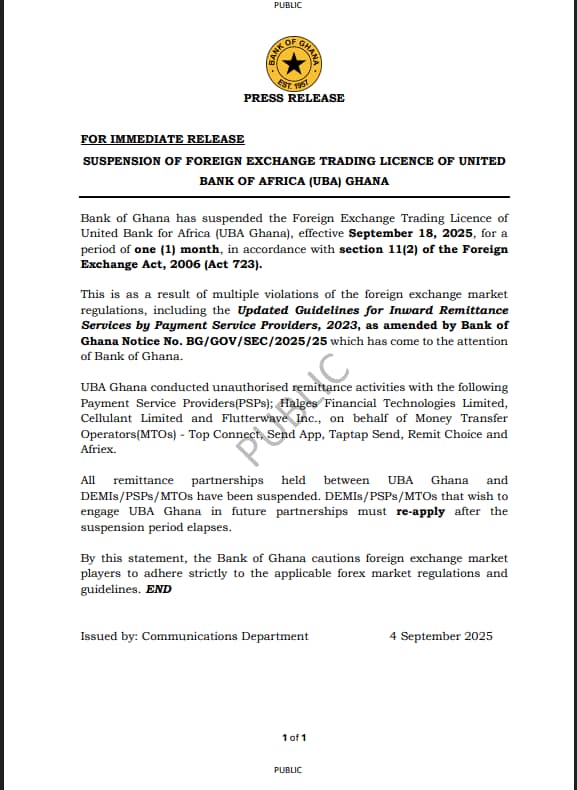

Some banks have been caught violating this directive. On Thursday, September 4, the Bank of Ghana announced that it has suspended the Foreign Exchange Trading Licence of United Bank for Africa (UBA Ghana), effective September 18, 2025, for a period of one month, in accordance with section 11(2) of the Foreign Exchange Act, 2006 (Act 723).

A statement issued by the BoG on Thursday, September 4, said that this is a result of multiple violations of the foreign exchange market regulations, including the Updated Guidelines for Inward Remittance Services by Payment Service Providers, 2023, as amended by Bank of Ghana Notice No. BG/GOV/SEC/2025/25, which has come to the attention of the Bank of Ghana.

“UBA Ghana conducted unauthorised remittance activities with the following Payment Service Providers(PSPs); Halges Financial Technologies Limited, Cellulant Limited and Flutterwave Inc., on behalf of Money Transfer Operators(MTOs) – Top Connect, Send App, Taptap Send, Remit Choice and Afriex.

“All remittance partnerships held between UBA Ghana and DEMIs/PSPs/MTOs have been suspended. DEMIs/PSPs/MTOs that wish to engage UBA Ghana in future partnerships must re-apply after the suspension period elapses.

“By this statement, the Bank of Ghana cautions foreign exchange market players to adhere strictly to the applicable forex market regulations and guidelines,” the statement said.

Read also

D-Black dismisses ‘Dbee’ claim, says his father died when he was just 12 years

Source:Lovinghananews.com

Thanks for reading from Lovin ghana news as a news publishing website from Ghana. You are free to share this story via the various social media platforms and follow us on; Facebook, TikTok, Twitter, WhatsApp Instagram YouTube etc.