The government has announced sweeping Value Added Tax (VAT) reforms aimed at easing the cost of doing business and putting more money in the hands of Ghanaians.

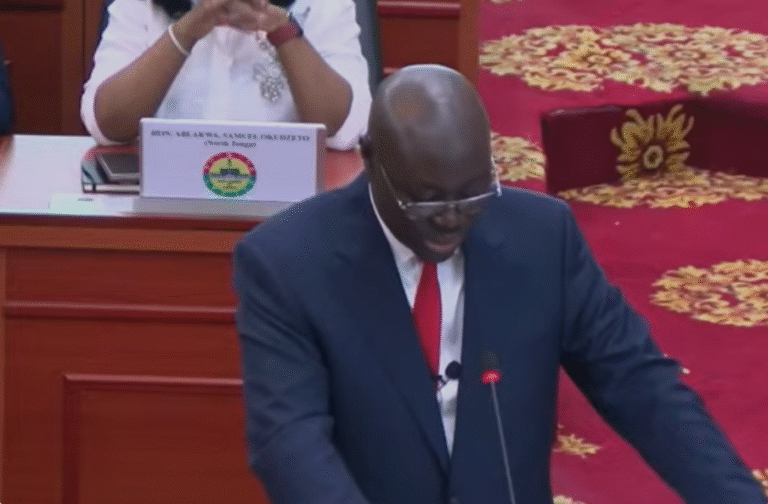

Presenting the 2026 Budget Statement and Economic Policy to Parliament on Thursday, November 19, the Minister for Finance, Dr. Cassiel Ato Forson, outlined a set of measures designed to simplify the tax regime, stimulate growth, and boost private sector confidence.

Under the new VAT reforms, the government will abolish the COVID-19 Health Recovery Levy and the decoupling of the GETFund and National Health Insurance Levy (NHIL) from the VAT tax base — allowing both levies to be subject to input tax deductions. VAT on reconnaissance and prospecting of minerals will also be scrapped.

Additionally, the effective VAT rate will be reduced from 21.9 percent to 20 percent, while the VAT registration threshold will be raised from GH¢200,000 to GH¢750,000. The zero-rating on locally manufactured textiles will also be extended to 2028.

“By abolishing the COVID-19 levy, Government is putting GH¢3.7 billion in the pockets of individuals and businesses in 2026 alone,” Dr. Forson said.

He added that the combined reforms are expected to reduce the cost of doing business by 5 percent, mainly as a result of allowing GETFund and NHIL levies to be deductible for input-output tax purposes.

Overall, the Finance Minister noted that the VAT reforms are projected to give back a total of GH¢5.7 billion to businesses and households in 2026, marking one of the most significant tax relief interventions under President John Dramani Mahama’s administration.