After Tuesday’s strong comeback, both bitcoin and ether ETFs stumbled again on Wednesday, Oct. 22. Investors pulled $101 million from bitcoin ETFs and nearly $19 million from ether funds, signaling a cautious mood in crypto markets.

Bitcoin ETFs Slip With $101 Million Outflow; Ether Follows With $19 Million Exit

Just a day after roaring back into inflow territory, crypto exchange-traded funds (ETFs) stumbled again midweek. The optimism that pushed billions into bitcoin and ether ETFs on Tuesday faded fast, replaced by a wave of cautious withdrawals.

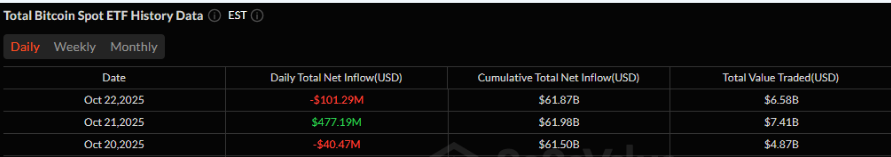

Bitcoin ETFs saw a net outflow of $101.29 million, a stark reversal from the prior session’s surge. Blackrock’s IBIT tried to keep momentum alive with a solid $73.63 million inflow, joined by a modest $2.14 million entry from Valkyrie’s BRRR.

But heavy redemptions drowned the positives. Grayscale’s GBTC ($56.63 million) and Fidelity’s FBTC ($56.56 million) led the outflows, while Ark & 21shares’ ARKB posted a $53.87 million exit and Bitwise’s BITB shed $9.99 million. Trading volume held strong at $6.58 billion, though net assets slipped to $146.27 billion.

Two days of outflows have dampened the week for bitcoin ETFs, although the week remains in the green due to the big inflow on Tuesday. Source: Sosovalue

Two days of outflows have dampened the week for bitcoin ETFs, although the week remains in the green due to the big inflow on Tuesday. Source: Sosovalue

Ether ETFs didn’t fare much better. Despite Blackrock’s ETHA pulling in a notable $110.71 million, the market leaned negative as redemptions piled up elsewhere. Fidelity’s FETH lost $49.46 million, Grayscale’s Ether Mini Trust shed $46.57 million, and ETHE saw $33.46 million flow out. The result, a $18.77 million net outflow, kept ether funds in the red for the day. Total trading value came in at $2.63 billion, with net assets easing to $25.81 billion.

After a brief burst of confidence, the midweek reversal shows investors remain selective and volatility continues to shape the ETF landscape for crypto’s biggest names.

Source:Lovinghananews.com