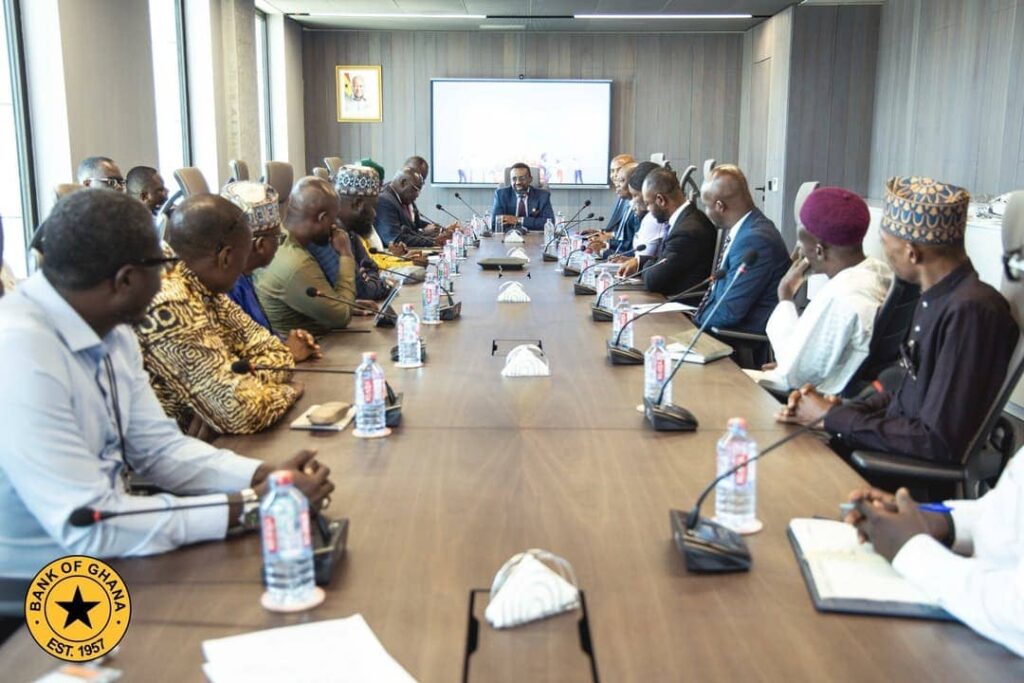

The Governor of the Bank of Ghana (BoG), Dr. Johnson Asiama and a team from the Bank, have met with representatives of various Islamic groups led by the Office of the National Chief Imam.

The meeting took place at Bank Square in Accra on September 3, 2025.

The meeting was part of the broader consultations towards the establishment of non-interest banking and Finance in Ghana.

Dr. Asiama emphasised at the meeting that non-interest banking would expand financial inclusion and create opportunities for all.

Sheikh Armiyawo Shaibu, Spokesperson for the National Chief Imam, stressed that non-interest banking should be seen more as a business case than a religious issue, highlighting its potential to serve both faith-based communities and the broader economy.

Dr Asiama earlier announced that an advisor to the Monetary Policy Committee of the Bank of Ghana (BoG), Professor John Gartchie Gatsi, was leading a team to help drive the introduction of Islamic Banking in Ghana.

Islamic banking is defined as a banking system which is in consonance with the spirit, ethos and value system of Islam and governed by the principles laid down by Islamic Shariah. Interest-free banking is a narrow concept denoting a number of banking instruments or operations which avoid interest.

Answering questions during the 124th MPC press conference in Accra on Friday, May 24, Dr Asiama stated emphatically that the Bank of Ghana has the internal capacity to handle Islamic Banking.

He said, “Professor Gatsi is purposely here to help drive this introduction. Let me say that we have internal capacity, we have some people who know what it takes and what to do. However, we need a few steps. The head of banking supervision has gone through a lot of programmes, he is very comfortable with them.

“The current banking law, which is Act 930, which we passed in 2016, provides for it. However, there were some lapses. For example, the establishment of the Sharia supervisory boards and the like. Those were not captured in Act 930, so Prof Gatsi and his team will be doing some work in that regard to ensure that we are able to operationalise Islamic financing, especially Islamic banking.

“Remember, it goes just beyond Islamic Banking, there are other aspects of financing involved. So we are working on it, hopefully very soon, when we are ready, we can consider licenses to establish an Islamic Bank.”

Read also

Cedi depreciates again on Friday Sept. 5 per Bank of Ghana rate

Source:Lovinghananews.com

Thanks for reading from Lovin ghana news as a news publishing website from Ghana. You are free to share this story via the various social media platforms and follow us on; Facebook, TikTok, Twitter, WhatsApp Instagram YouTube etc.