Governor of the Bank of Ghana (BoG) Dr Johnson Asiama, has said that a proposal is being prepared for submission to Parliament, which will pave the way for the implementation phase for the non-interest banking and finance.

He said that when parliament resumes sitting, the BoG team will engage the lawmakers on the proposal.

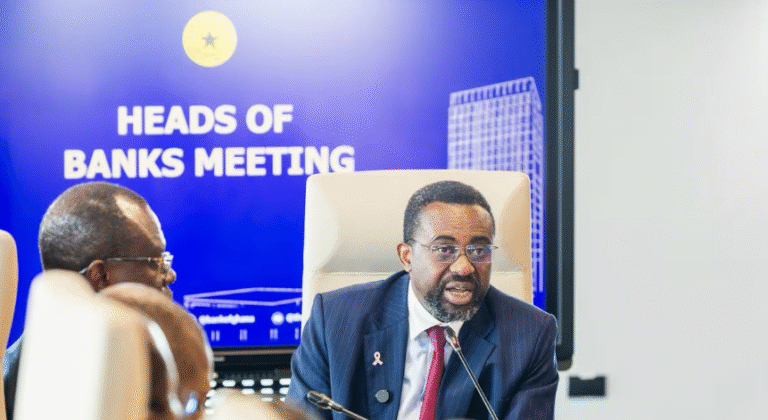

Dr Asiama said this during the 126th Monetary Policy Committee (MPC) press conference, when asked for the latest update regarding the progress on non-interest banking and finance.

In answer, he said, ” Professor [John] Gatsi and his team have made commendable progress. We have conducted several sensitisation programmes, and the process is nearing completion.

“I understand that a proposal is being prepared for submission to Parliament, which will pave the way for the implementation phase. Regarding the possibility of licensing institutions by the end of the year, we are sparing no effort to meet the timeline. That said, as you may be aware, Parliament is currently in recess and is due to reconvene in October.

“Upon their return, we will engage with them to expedite the process as far as possible. Our commitment to this initiative remains unwavering, and we are pressing on to ensure its success.”

On 18th September 2025, a Bank of Ghana team on Non-Interest Banking and Finance (NIBF), led by Prof. John Gatsi, Advisor at the Bank, on behalf of the Governor, engaged representatives of Christian and Muslim leaders at the Bank Square.

The meeting was part of the Bank’s ongoing stakeholder consultations towards the development of an inclusive regulatory framework for the rollout of NIBF in Ghana. Discussions touched on international regulatory standards, governance structures, and the establishment of both NIBF windows within conventional banks and fully fledged NIBF institutions.

Prof. Gatsi emphasised that NIBF would enhance financial inclusion, broaden economic opportunities, and expand consumer choice—ensuring fairness and non-discrimination.

Leaders of both faith groups expressed appreciation to the Bank for creating space for dialogue and collaboration on this important initiative.

The Bank of Ghana said it remains committed to fostering a financial system that serves all Ghanaians.

Source:Lovinghananews.com