Stablecoin market capitalization has surpassed $300 billion for the first time, led by Tether and USDC, with Ethena’s yield-bearing USDe as the third-largest player. The milestone highlights both crypto’s growing liquidity base and shifting competitive dynamics.

USDT and USDC Dominate as USDe Gains Ground in Stablecoin Market

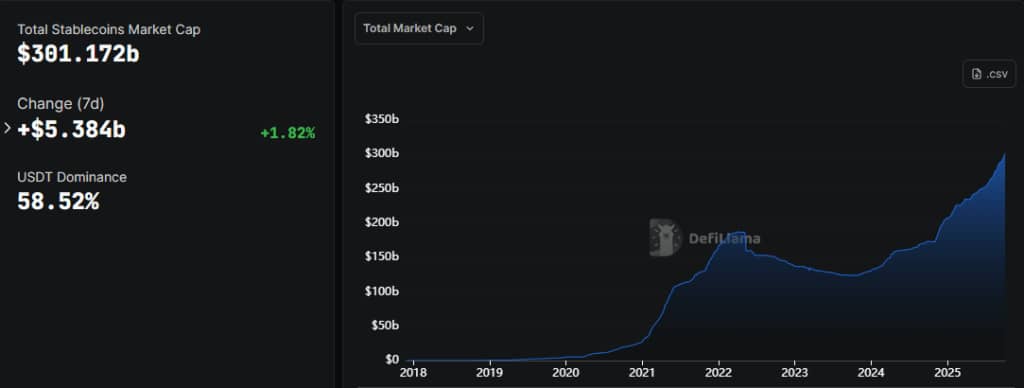

The total value of stablecoins in circulation has crossed $300 billion for the first time, according to Defillama data, a landmark that underscores crypto’s deepening role in global finance.

Tether’s USDT remains the dominant player with a market share of 58.52% and $176.3 billion. Circle’s USDC follows with $74 billion, while Ethena’s USDe, a yield-bearing synthetic dollar, has climbed to $14.83 billion, cementing its position as the third-largest stablecoin.

While the headline figure marks a straightforward growth story, the composition of the market reveals a more nuanced shift. For years, the stablecoin sector has been defined by a Tether-Circle duopoly. Now, yield-bearing alternatives like USDe are changing the competitive landscape, offering holders not just stability but income.

Source: Defillama

Source: Defillama

That evolution is accelerating institutional interest. Citigroup projects the stablecoin market could grow to $1.9 trillion by 2030, with upside potential of $4 trillion, framing stablecoins as an essential complement to tokenized deposits in modernizing payments and capital markets.

The $300 billion milestone also underscores how stablecoins function as the liquidity backbone of crypto. Stablecoins power DeFi protocols, cross-border payments, trading markets, and increasingly bridge traditional and tokenized assets.

Still, Tether and Circle maintain more than 80% market share, and both benefit from regulatory positioning and distribution networks. But as yield and compliance frameworks converge, the competition for dominance is set to intensify.