Last week, Donald Trump reminded traders that he can still move markets with a tweet, a tariff, or a firing. Crypto whipsawed on his words and actions.

This editorial is from last week’s edition of the Week in Review newsletter. Subscribe to the weekly newsletter to get the editorial the second it’s finished.

Trump as Market Catalyst

The bitcoin lows around $116,000 mentioned in the newsletter two weeks ago did, in fact, break down. The price dipped to $112K before rebounding past $116K to $117K. At the time of writing it is once again drifting toward $116K, but unlike two week ago, the odds that this level will hold look good.

Much of last week’s price action can be traced, directly or indirectly, to Donald Trump. Trump has been easy on us recently, but last week was a reminder that the man can command markets when he wants to. A hilarious post that circulated widely among the elite tradfi traders I follow shows how vital following Trump has become.

Trump’s firing of Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer last Friday, which contributed to the precipitous drop, produced longer posts well worth the read from both supporters such as Ray Dalio and detractors. By Sunday people had apparently moved on, because crypto had recovered and equities joined the rebound on Monday.

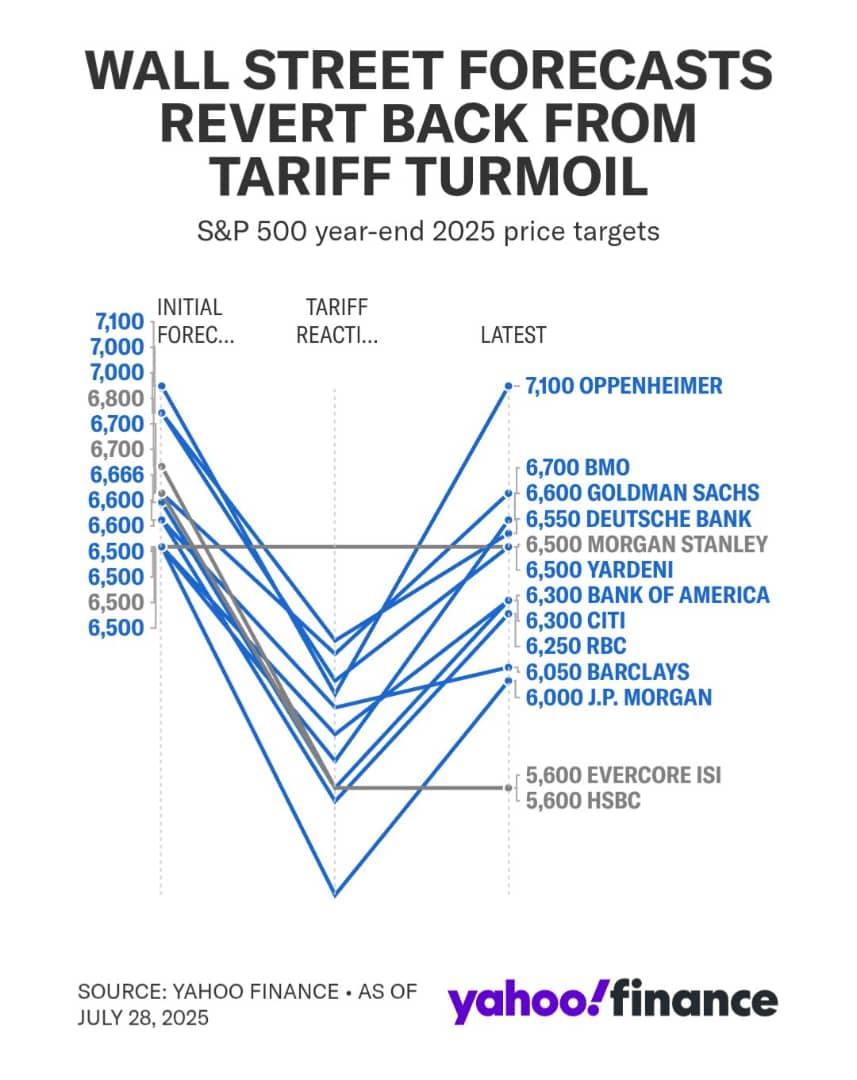

In a Tuesday interview, Trump’s latest tariff announcement produced the usual knee-jerk drop followed by an equally familiar rally. How many times has this happened? The following chart shows the histrionic short term impact to markets, but negligible impact of Trump’s tariffs thus far.

Bloomberg’s Eric Balchunas put it succinctly: “Chart of the Year. Says it all.”

On Thursday, crypto markets pumped off the back of two Trump Executive Orders (EO) “relevant to the crypto community.” The first prohibits federal regulators from enabling financial institutions to deny services based on political beliefs, religious beliefs, or lawful business activities such as crypto services. Basically, it stops Operation 2.0-style clampdowns. The second changes federal retirement plan rules (401(k) and similar retirement plans) to permit the inclusion of assets such as cryptocurrencies.

The 401(k) EO made me ruminate on Jordi Alexander’s thoughtful post from earlier in the week about how much it takes to feel rich these days. Here’s the first half of the post:

Figs arent what they used to be, even 5-10 years ago

these days-

$100k= dont feel rich

$1m = ‘7 fig hell’

$10m+ = unsettled..

the notional loss you take every year from fiat dilution is so high, if you take your foot off the gas even a bit on earning you don’t even tread water

Perhaps this is a stretch, but policy shifts like the 401(k) EO either are in response to, or further signal that simply maintaining your current level of wealth, let alone moving up a notch, is a rising target that is accelerating.

Also on Thursday, the White House announced the nomination of Stephen Miran to a temporary position on the Federal Reserve Board. It was met with congratulations by many, and interpreted as a shift to more dovish monetary policy, i.e., rate cuts are more likely than they already were.

In non-Trump news (that still somehow is connected to his administration!), open-source software, privacy, and decentralization suffered a blow on Wednesday when Tornado Cash developer Roman Storm was convicted of conspiracy to operate an unlicensed money transmitting business.

This verdict followed last week’s bad news. The co‑founders of the privacy‑focused bitcoin mixer Samourai Wallet pleaded guilty to conspiracy to operate an unlicensed money‑transmitting business in order to avoid more severe charges.

The implications of these verdicts are wide-ranging and pivotal for the crypto ecosystem. Unfortunately, as it stands now, those implications are negative. For a long, full discussion on this topic, check out last week’s episode of Token Narratives.

Finally, the whale who bought bitcoin in 2011 and finally realized $9 billion in profit a couple of weeks ago caused an outpouring of people seriously entertaining the thought, “If only I had put $100 in bitcoin in 2010—Today I’d be a billionaire too.” If you or anyone you know has done this, you must read this post. It hammers home how you definitely wouldn’t have! That whale was an outlier.

Source:news.bitcoin.com